Ira interest calculator

The provided calculations do not constitute. Currently you can save 6000 a yearor 7000 if youre 50 or older.

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Figures based on the Federal IRS.

. Unfortunately there are limits to how much you can save in an IRA. Enter the amount of your contributions per year. Enter the number of years until your retirement.

Please pick two dates enter an amount owed to the IRS and click Calculate. While long term savings in a Roth IRA may produce. Enter the percentage of your expected rate of return the.

Retirement Withdrawal Calculator Terms and Definitions. Amount that you plan to add to the principal every month or a negative number for the amount that you plan to withdraw every month. Axos Banks evolved banking model offers incredible returns at a low cost to you our customer.

Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth. Amount You Expected to Withdraw This is the budgeted. Roth IRA calculator.

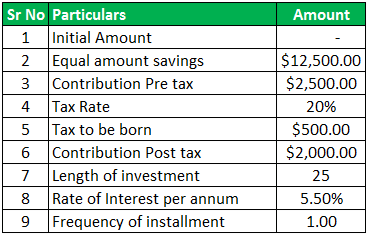

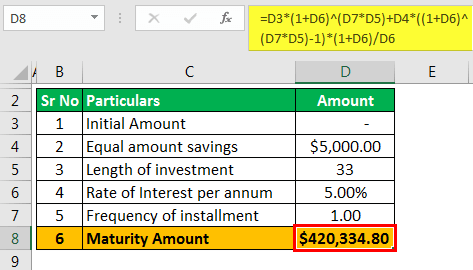

Just input a few details including your age tax-filing status IRA. One needs to follow the below steps in order to calculate the maturity amount. Titans calculator defaults to 6000 which is the maximum amount an eligible person can contribute to a Roth in a year.

From 1993 through 2012 the average annual interest on a five-year CD was 5116 percent which works out to roughly 0014 percent interest per day. Not everyone is eligible to contribute this. 95000 invested for 20 years at that.

The calculator will estimate the value of the Roth IRAs tax-free investment growth by comparing your projected Roth IRA account balance at retirement with the balance you would have if you. Our Schwab IRA calculators can help you get the information and answers you need to inform your financial decisions. Smarter savings means more money to reach your.

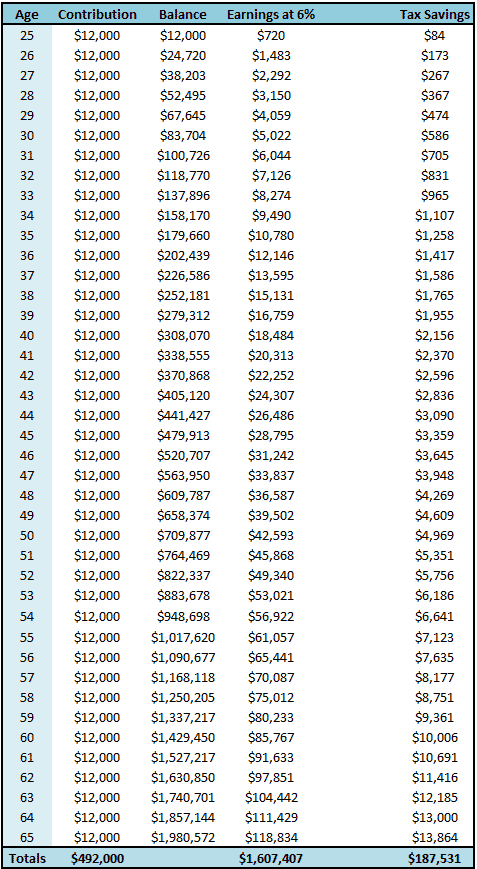

Use this IRA calculator to estimate how much your annual contributions will be worth when you reach retirement age. Enter your current IRA balance. This calculator allows you to choose the frequency that your.

Determine the initial balance of the account if any and also there will be a fixed periodical. Expected Retirement Age This is the age at which you plan to retire. Never settle for meager interest yields.

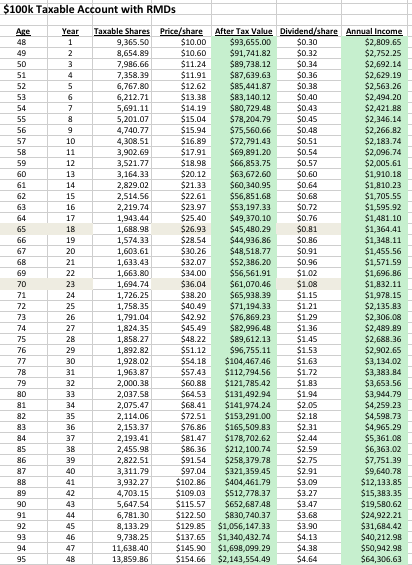

The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from your retirement accounts annually. This IRS penalty and interest calculator provides accurate calculations for the failure to file failure to pay and accuracy-related penalties. 39 rows IRS Interest Calculator.

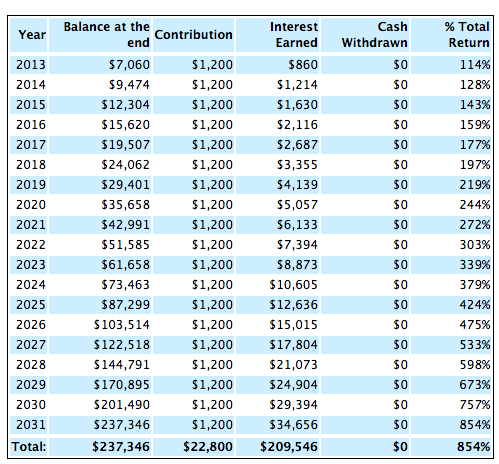

Interest earned on your CDs accumulated interest. Calculate your earnings and more.

Calculating The Value Of Your Backdoor Roth Contributions Physician On Fire

/ira-5bfc2f9346e0fb00260be21a.jpg)

Can A Person Who Is Retired Continue To Fund An Ira

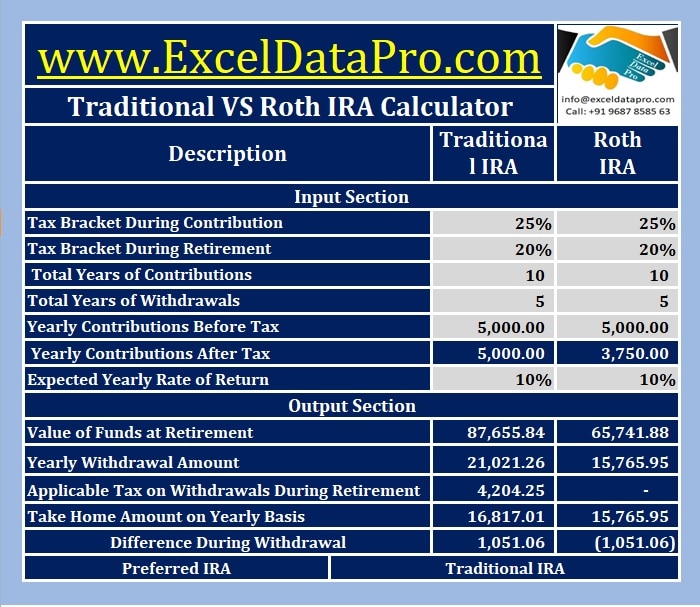

Traditional Vs Roth Ira Calculator

This Could Be The Perfect Stock For A Roth Ira Nyse O Seeking Alpha

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Ira Kids Compound Interst Growth Of Roth Iras A Kid S Key To Future Wealth

Traditional Ira Calculator Calculate Maturity After Retirement

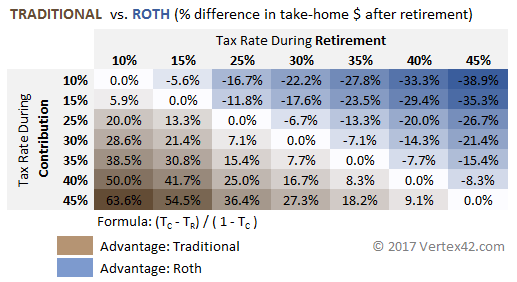

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Ira Calculator See What You Ll Have Saved Dqydj

Top 5 Best Roth Ira Calculators 2017 Ranking Conversion Contribution Growth Retirement Early Withdrawal Calculators Advisoryhq

Should I Convert My Dividend Growth Ira To A Roth Ira Seeking Alpha

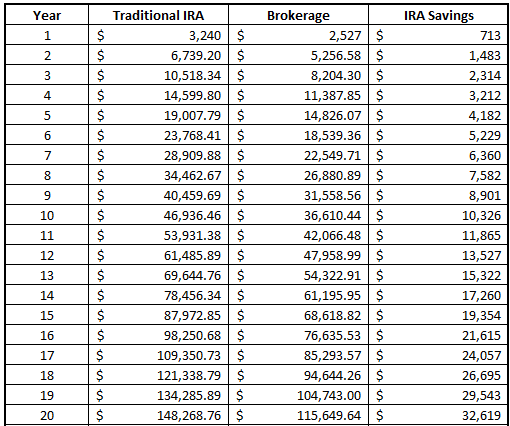

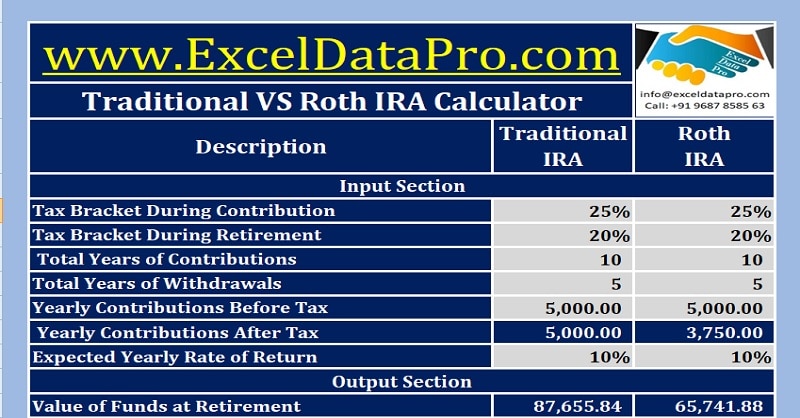

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Roth Ira Calculator Roth Ira Contribution

Traditional Vs Roth Ira Calculator

/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

Recharacterizing Your Ira Contribution

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Roth Ira Calculators